In the digital landscape where convenience reigns supreme, accessing financial information and managing transactions efficiently is paramount. In this realm, Mypay stands as a beacon of streamlined accessibility, offering users a secure gateway to their financial accounts and services. Emphasizing user empowerment and ease of use, Mypay login brings forth a seamless experience for individuals and businesses alike, bridging the gap between the virtual and tangible aspects of modern finance.

Empowerment through Access: Mypay login serves as the key to unlocking a realm of financial empowerment. By providing users with swift and secure access to their accounts, Mypay enables individuals to take control of their financial destinies with confidence and ease. Whether it’s checking balances, initiating transfers, or monitoring transactions, Mypay login puts the power of financial management directly into the hands of its users.

Security as a Foundation: Amidst the digital age’s ever-evolving landscape, security remains paramount. Mypay understands this fundamental need and prioritizes the protection of user data with robust encryption protocols and stringent authentication measures. Through a combination of cutting-edge technology and unwavering commitment to user privacy, Mypay login ensures that every interaction is shielded from potential threats, fostering trust and peace of mind among its users.

Unlocking the Power of Mypay Login: Your Gateway to Financial Management

Understanding Mypay Login: Features and Benefits

In this section, we delve into the intricacies of Mypay Login, shedding light on its array of features and the manifold benefits it offers to users. Mypay Login serves as more than just a portal; it’s a comprehensive tool designed to empower individuals in managing their finances efficiently. Through a detailed exploration, we uncover how Mypay Login simplifies financial transactions, provides insightful analytics, and facilitates seamless communication with financial institutions.

Here, we embark on a journey to unravel the layers of functionality embedded within Mypay Login. From its intuitive user interface to its robust security measures, each aspect is meticulously crafted to enhance the user experience and foster financial well-being. Through a systematic breakdown, we elucidate the key features that distinguish Mypay Login as a premier platform for financial management.

- Streamlined Account Access: Mypay Login offers users a centralized hub for accessing various financial accounts, streamlining the process of monitoring balances, transactions, and account details.

- Comprehensive Financial Overview: With Mypay Login, users gain access to comprehensive financial summaries, including expense tracking, budgeting tools, and customizable financial reports, enabling informed decision-making.

- Convenient Payment Solutions: Mypay Login facilitates seamless bill payments, fund transfers, and recurring payments, saving users time and eliminating the hassle associated with traditional banking methods.

- Personalized Alerts and Notifications: Mypay Login keeps users informed about account activity, sending timely alerts for transactions, account updates, and potential security risks, enhancing financial awareness and security.

- Enhanced Security Measures: With advanced encryption protocols and multi-factor authentication, Mypay Login prioritizes the security of user data, safeguarding against unauthorized access and fraud.

As we delve deeper into the functionalities of Mypay Login, we uncover how these features collectively contribute to a seamless and secure financial management experience. Whether it’s monitoring expenses, setting financial goals, or analyzing spending patterns, Mypay Login empowers users to take control of their finances with confidence.

Join us as we explore the dynamic landscape of Mypay Login, where innovation meets convenience, and embark on a journey towards financial empowerment.

Understanding Mypay Login: Features and Benefits

In this section, we delve into the intricate workings of Mypay Login, shedding light on its myriad features and the benefits they offer to users. Setting up a Mypay account is not just about gaining access to financial management tools but unlocking a world of convenience and efficiency.

Let’s explore step-by-step how to set up your Mypay Login:

- Begin by navigating to the Mypay website and locating the “Sign Up” or “Register” option.

- Click on the registration link and provide the required personal information, including your name, email address, and any other details as prompted.

- Create a strong, unique password that combines letters, numbers, and special characters to enhance the security of your account.

- Once you’ve filled in all the necessary fields, review the terms and conditions, and privacy policy before proceeding.

- After agreeing to the terms, submit your registration details, and await a verification email.

- Check your email inbox for the verification message from Mypay and click on the provided link to confirm your registration.

- Upon successful verification, return to the Mypay website and log in using your newly created credentials.

- Once logged in, you’ll gain access to a wealth of financial management tools and resources tailored to your needs.

By following these simple steps, you’ll be well on your way to harnessing the full potential of Mypay Login, empowering yourself to take control of your finances with ease and confidence.

Step-by-Step Guide to Mypay Login Setup

In this section, we will walk you through the process of setting up your Mypay login with easy-to-follow steps. Your Mypay account is the gateway to managing your finances conveniently and securely, and ensuring its setup is done correctly is crucial for a smooth user experience.

1. Creating Your Mypay Account

The first step in setting up your Mypay login is to create your account. Visit the official Mypay website and locate the signup or registration option. You will be prompted to provide necessary personal information such as your name, email address, and contact details. Ensure that the information you provide is accurate to prevent any issues with account verification in the future.

2. Choosing a Strong Password

Once you’ve completed the signup process, you will need to choose a strong password for your Mypay account. A strong password typically consists of a combination of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable passwords or ones that are related to personal information to enhance the security of your account.

Now that you have created your Mypay account and set up a strong password, you are ready to explore the various features and functionalities offered by the platform. However, before delving into managing your finances, it’s essential to ensure that your Mypay account is safeguarded against potential security threats.

Maximizing Mypay: Tips and Tricks for Efficient Usage

Unlocking the full potential of Mypay entails more than just a mere login; it requires a nuanced understanding of its features and functionalities. In this section, we delve into expert tips and strategies to leverage Mypay to its fullest, optimizing your financial management experience.

1. Organize Your Transactions

Efficient usage of Mypay begins with meticulous organization of your transactions. Utilize categorization features to allocate expenses accurately, enabling you to track spending patterns and budget effectively. Assigning labels and tags to transactions enhances clarity and simplifies financial analysis.

2. Automate Recurring Payments

Simplify your financial routine by automating recurring payments through Mypay. Set up scheduled transactions for bills, subscriptions, and loans to ensure timely payments without manual intervention. By automating these processes, you minimize the risk of missing deadlines and incur late fees, fostering financial discipline and peace of mind.

Furthermore, explore the option to link external accounts and streamline transfers between different financial platforms. Seamless integration enhances convenience and centralizes financial management, enabling you to monitor all transactions within the Mypay ecosystem.

Maximizing Mypay extends beyond basic functionality; it involves harnessing its capabilities to streamline financial tasks, optimize budgeting, and cultivate sound financial habits. By implementing these tips and tricks, you unlock the full potential of Mypay, empowering you to take control of your financial journey with confidence and efficiency.

Exploring Additional Services Linked to Mypay Login

In this section, we delve into the array of supplementary services seamlessly integrated with Mypay login, enriching users’ financial management experience. Beyond the fundamental functionalities, Mypay extends its utility by offering a spectrum of services tailored to cater to diverse financial needs and preferences.

1. Enhanced Budgeting Tools

One of the core facets of Mypay’s additional services revolves around bolstering users’ budgeting capabilities. Through intuitive interfaces and analytical tools, Mypay empowers individuals to gain deeper insights into their spending patterns, set realistic financial goals, and track their progress effortlessly. Whether it’s categorizing expenses, setting up automated alerts, or generating insightful reports, Mypay equips users with the resources necessary to navigate their financial journeys with precision and confidence.

| Feature | Description |

|---|---|

| Expense Categorization | Effortlessly categorize expenses into customizable groups for better organization and analysis. |

| Automated Alerts | Set up personalized alerts for budget thresholds, upcoming payments, or unusual spending activities to stay on track. |

| Insightful Reports | Access comprehensive reports and visualizations that provide a clear overview of financial trends and patterns. |

2. Seamless Integration with Third-Party Financial Tools

Recognizing the importance of interoperability in today’s digital ecosystem, Mypay offers seamless integration with a myriad of third-party financial tools and platforms. By leveraging APIs and strategic partnerships, Mypay enables users to consolidate their financial data from various sources, facilitating a holistic view of their financial landscape. Whether it’s linking investment portfolios, syncing credit card accounts, or integrating with personal finance apps, Mypay streamlines the process of managing multiple financial streams, fostering greater efficiency and convenience.

| Integration | Benefits |

|---|---|

| Investment Portfolios | Track investment performance and portfolio diversification alongside day-to-day transactions for comprehensive financial planning. |

| Credit Card Accounts | Monitor credit card transactions and balances seamlessly within the Mypay interface for better debt management and fraud detection. |

| Personal Finance Apps | Sync data with popular personal finance apps to leverage advanced budgeting, saving, and investment features while retaining the convenience of Mypay’s central dashboard. |

By embracing these additional services, users can unlock new dimensions of financial control and optimization, harnessing the full potential of Mypay as a comprehensive financial management platform.

Exploring Additional Services Linked to Mypay Login

Within the realm of Mypay Login, an array of supplementary services extends beyond the core functionalities, enriching the user experience and expanding the platform’s utility. These additional services encompass a spectrum of features designed to enhance financial management, streamline transactions, and offer personalized solutions, fostering a comprehensive ecosystem around the Mypay framework.

One prominent facet of these supplementary services involves tailored financial insights and advisory tools, aimed at empowering users with actionable intelligence to make informed decisions regarding their finances. Through analytical algorithms and data-driven recommendations, users gain valuable perspectives on budgeting, investment opportunities, and debt management, leveraging the platform as a personalized financial advisor.

Moreover, Mypay Login integrates seamlessly with a variety of third-party applications and financial institutions, facilitating convenient access to a broader range of services within a unified interface. This interoperability extends the platform’s functionality beyond basic banking tasks, encompassing services such as loan applications, insurance management, and investment portfolio tracking, thereby consolidating disparate financial activities into a cohesive digital ecosystem.

Furthermore, Mypay’s ecosystem encompasses features tailored to specific user demographics and preferences, catering to diverse needs and lifestyles. Whether it’s specialized tools for small business owners, educational resources for students, or budgeting aids for families, the platform offers customized solutions to address varied financial goals and scenarios.

In essence, the exploration of additional services linked to Mypay Login reveals a multifaceted landscape of tools, partnerships, and capabilities aimed at enriching the user experience and fostering financial empowerment. By embracing innovation and collaboration, Mypay continues to evolve as a holistic platform, poised to meet the evolving needs and aspirations of its users in an ever-changing digital landscape.

Future Innovations: What’s on the Horizon for Mypay Users?

In this section, we delve into the exciting realm of future innovations awaiting Mypay users. As technology evolves and consumer needs shift, Mypay is poised to introduce cutting-edge features and services aimed at enhancing user experience, streamlining financial management, and staying ahead in the digital finance landscape.

As Mypay continues to grow and adapt to the dynamic demands of its user base, anticipation mounts for the forthcoming advancements that will redefine how users interact with the platform. Let’s explore some potential innovations that could shape the future of Mypay:

- Advanced Security Protocols: With cybersecurity threats evolving constantly, Mypay is committed to implementing robust security measures to safeguard user data and transactions. Future updates may include biometric authentication, advanced encryption protocols, and real-time fraud detection algorithms to ensure unparalleled security.

- Personalized Financial Insights: Harnessing the power of artificial intelligence and machine learning, Mypay aims to provide users with personalized financial insights tailored to their spending habits, saving goals, and investment preferences. Imagine receiving proactive recommendations for optimizing your financial health based on your unique financial profile.

- Integration with Emerging Technologies: Mypay recognizes the potential of emerging technologies such as blockchain, cryptocurrency, and decentralized finance (DeFi) in shaping the future of finance. Integration with these technologies could open up new avenues for secure, decentralized transactions, borderless payments, and innovative financial products.

- Enhanced User Interface and Experience: User feedback is integral to Mypay’s continuous improvement efforts. Future updates may focus on refining the user interface, streamlining navigation, and introducing intuitive features to enhance overall user experience. From customizable dashboards to seamless account management, Mypay is committed to making financial management effortless and intuitive.

- Expansion of Service Ecosystem: In line with its commitment to empowering users with comprehensive financial solutions, Mypay is exploring partnerships and collaborations to expand its service ecosystem. This may involve integration with third-party financial apps, introduction of new financial products, and access to exclusive deals and offers tailored to Mypay users.

These are just a few glimpses into the potential future innovations awaiting Mypay users. As the fintech landscape continues to evolve, Mypay remains dedicated to staying at the forefront of innovation, empowering users with the tools and technologies they need to achieve their financial goals.

Q&A:,

What is Mypay login?

Mypay login is a secure online portal provided by the Department of Defense for military members, retirees, and civilian employees to access their pay and benefits information.

How do I create a Mypay login account?

To create a Mypay login account, visit the Mypay website and click on the “Create Account” option. You’ll need to provide your personal information, including your Social Security Number, to verify your identity and set up your account.

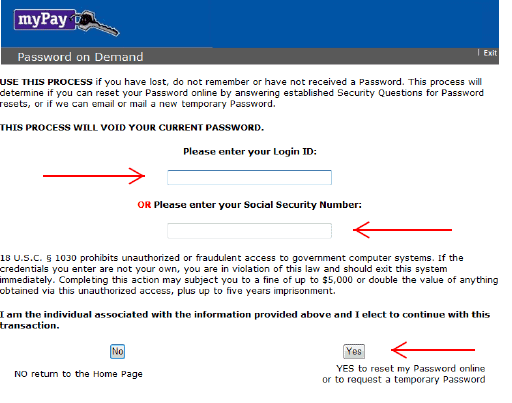

What can I do if I forget my Mypay login password?

If you forget your Mypay login password, you can click on the “Forgot Password” link on the login page. Follow the prompts to reset your password, which may involve answering security questions or receiving a temporary password via email or text message.

Is Mypay login available for family members of military personnel?

No, Mypay login is primarily designed for active duty, reserve, and retired military members, as well as civilian employees of the Department of Defense. Family members typically do not have access to Mypay accounts.