Mypay.dfas serves as the cornerstone of modern financial management, providing a comprehensive platform for individuals to navigate their financial affairs with ease and efficiency. Whether you’re a service member, a civilian employee, or a retiree, this innovative system offers a seamless experience tailored to your unique needs.

Through Mypay.dfas, users gain access to a suite of tools and resources designed to simplify tasks such as payroll management, benefits administration, and retirement planning. With its user-friendly interface and robust features, navigating the complexities of financial management becomes a straightforward endeavor, allowing individuals to focus more on their mission and less on administrative burdens.

Join us as we delve into the myriad capabilities of Mypay.dfas, exploring how it revolutionizes the way individuals interact with their finances, empowering them to achieve greater financial security and peace of mind.

Convenient Online Access

In today’s digital age, accessibility is paramount, especially when it comes to managing finances. This section delves into the importance of convenient online access in facilitating secure and efficient financial transactions for military personnel. From streamlining payroll processes to ensuring timely access to financial resources, the online platform serves as a vital tool in enhancing convenience and ease of use for service members.

- 24/7 Accessibility: One of the key benefits of online access is the ability for military personnel to manage their finances anytime, anywhere. Whether stationed overseas or deployed on missions, individuals can securely access their accounts and initiate transactions at their convenience.

- Streamlined Transactions: Gone are the days of waiting in line or mailing paperwork for financial matters. With a few clicks, service members can effortlessly transfer funds, pay bills, or update personal information online, saving time and reducing administrative hassles.

- Enhanced Security Measures: The online platform incorporates robust security features to safeguard sensitive financial data. From encryption protocols to multi-factor authentication, every effort is made to ensure that transactions are conducted securely, minimizing the risk of fraud or unauthorized access.

- Real-time Updates: Online access provides instant visibility into pay statements, allowances, and deductions, allowing service members to stay informed about their financial status at all times. This real-time information empowers individuals to make informed decisions and effectively manage their finances.

- Mobile Compatibility: Recognizing the evolving needs of service members, the online platform is designed to be mobile-friendly, enabling seamless access from smartphones and tablets. This flexibility ensures that personnel can stay connected to their finances, even while on the go.

By leveraging the convenience of online access, military personnel can effectively navigate their financial responsibilities with greater ease and efficiency, allowing them to focus more on their mission and duties with peace of mind.

Secure Financial Transactions

In this section, we delve into the significance of ensuring secure financial transactions within the realm of personalized payroll solutions. With the evolving landscape of digital transactions and the increasing complexity of financial systems, the need for robust security measures has never been more pronounced.

Within the framework of personalized payroll solutions, the aspect of secure financial transactions encompasses a multifaceted approach aimed at safeguarding sensitive financial data and ensuring the integrity of monetary exchanges. It involves implementing encryption protocols, stringent authentication mechanisms, and proactive monitoring systems to mitigate the risks associated with unauthorized access, fraud, and data breaches.

Moreover, the emphasis on secure financial transactions extends beyond mere compliance with regulatory standards; it underscores a commitment to upholding the trust and confidence of military personnel in the payroll system. By prioritizing the protection of financial information and facilitating seamless transactions, organizations can foster a conducive environment for financial stability and peace of mind among service members.

Furthermore, the integration of advanced technologies such as blockchain and biometric authentication offers promising avenues for enhancing the security and transparency of financial transactions. These innovative solutions not only fortify the resilience of payroll systems against external threats but also streamline processes, thereby optimizing efficiency and reducing administrative overhead.

In essence, the pursuit of secure financial transactions within personalized payroll solutions epitomizes a proactive stance towards safeguarding the financial well-being of military personnel. By leveraging state-of-the-art security measures and embracing technological innovations, organizations can uphold the highest standards of integrity, reliability, and confidentiality in financial operations.

Personalized Payroll Solutions

In the realm of financial management, personalized payroll solutions stand as pivotal tools in addressing the diverse needs and preferences of individuals within an organization. This section delves into the intricate mechanisms that enable tailored approaches to managing allowances and deductions, ensuring that each member receives compensation aligned with their unique circumstances and requirements.

Understanding Allowances and Deductions

Allowances and deductions form the backbone of an individual’s financial compensation framework, encompassing a myriad of factors ranging from taxes to benefits. This subsection elucidates the significance of comprehending the intricacies of these components, as they directly impact an individual’s take-home pay and overall financial well-being.

Streamlining Management Processes

Efficiently managing allowances and deductions demands streamlined processes that accommodate the dynamic nature of personnel finances. This segment explores strategies and technologies aimed at optimizing payroll management, ensuring accuracy, transparency, and timeliness in disbursing financial resources to milit

Managing Allowances and Deductions

In the dynamic landscape of financial management, effective handling of allowances and deductions stands as a pivotal aspect for individuals and organizations alike. This section delves into the nuanced strategies and methodologies employed in navigating these financial intricacies.

The Significance of Allowances

Allowances serve as crucial components in financial planning, encompassing various facets such as housing, transportation, and subsistence. Understanding the allocation and utilization of allowances is paramount for ensuring optimal resource management and budgetary efficiency.

Optimizing Deductions

Deductions form another essential element in financial management, offering avenues for mitigating tax liabilities and maximizing savings. Exploring the diverse array of deductions available enables individuals to strategize effectively, aligning their financial goals with regulatory frameworks.

Resources for Financial Planning

In the realm of military service, financial planning stands as a cornerstone of stability and preparedness. This section delves into the array of resources available to servicemen and women to navigate the complex terrain of financial management. From tailored advice to comprehensive toolkits, military personnel are equipped with a suite of resources to optimize their financial well-being and chart a course towards fiscal security.

Financial Consultation Services

Within the military ecosystem, financial consultation services serve as guiding beacons, offering personalized guidance tailored to the unique circumstances of each individual. These services provide a platform for personnel to engage in one-on-one discussions with seasoned financial advisors, facilitating informed decision-making and long-term financial planning.

Online Financial Literacy Courses

Embracing the digital age, online financial literacy courses cater to the diverse learning preferences of military personnel. These courses cover a spectrum of topics, from basic budgeting principles to advanced investment strategies, empowering individuals to bolster their financial acumen at their own pace and convenience.

- Basic budgeting techniques

- Investment strategies

- Retirement planning

- Debt management

By leveraging these resources, military personnel can navigate the complexities of financial planning with confidence, ensuring financial resilience both during and after their service.

Enhancing Military Personnel Support

In this section, we delve into the comprehensive strategies aimed at bolstering the support systems for military personnel. The welfare and well-being of service members are paramount, and through concerted efforts, various initiatives have been devised to ensure their needs are met effectively.

Implementing Holistic Support Programs

Enhancing military personnel support involves implementing holistic programs that address diverse aspects of their lives. These initiatives go beyond just financial assistance; they encompass mental health services, family support programs, career development opportunities, and more. By offering a range of support services, the aim is to foster resilience and overall well-being among military personnel and their families.

- Providing Accessible Mental Health Services: Access to confidential counseling services and resources for addressing stress, trauma, and other mental health challenges is crucial. By removing barriers to seeking help, such as stigma or logistical obstacles, service members are encouraged to prioritize their mental well-being.

- Supporting Military Families: Recognizing the integral role of families in the lives of service members, initiatives are in place to provide support and resources to military spouses, children, and other dependents. This may include educational assistance, childcare services, and community networking opportunities.

- Promoting Career Development and Transition Assistance: As military personnel transition to civilian life, comprehensive support is essential for a smooth and successful transition. Career counseling, job placement assistance, and educational benefits help service members navigate this significant life change with confidence and optimism.

Embracing Technological Innovations

Technological advancements play a pivotal role in enhancing military personnel support. From streamlined communication platforms to sophisticated data analytics, leveraging technology enables more efficient and personalized support services.

- Utilizing Data Analytics for Tailored Assistance: By analyzing data related to service members’ needs and preferences, support services can be customized to better address individual requirements. This data-driven approach ensures that resources are allocated effectively, maximizing their impact.

- Enhancing Communication and Accessibility: Online platforms and mobile applications provide convenient channels for accessing support services and information. Whether it’s scheduling appointments, accessing educational resources, or connecting with support networks, digital platforms facilitate seamless communication and accessibility.

- Facilitating Remote Support Services: Particularly relevant in remote or deployed settings, remote support services enable service members to access assistance regardless of their location. Telehealth services, virtual counseling sessions, and online support groups ensure continuity of care and support, even in challenging environments.

By embracing a multifaceted approach that combines traditional support mechanisms with innovative solutions, the aim is to continuously enhance military personnel support and uphold the well-being of those who serve.

Q&A:,

What is Mypay.dfas?

Mypay.dfas is an online platform provided by the Defense Finance and Accounting Service (DFAS) for military members, retirees, and Department of Defense civilian employees to manage their pay and benefits.

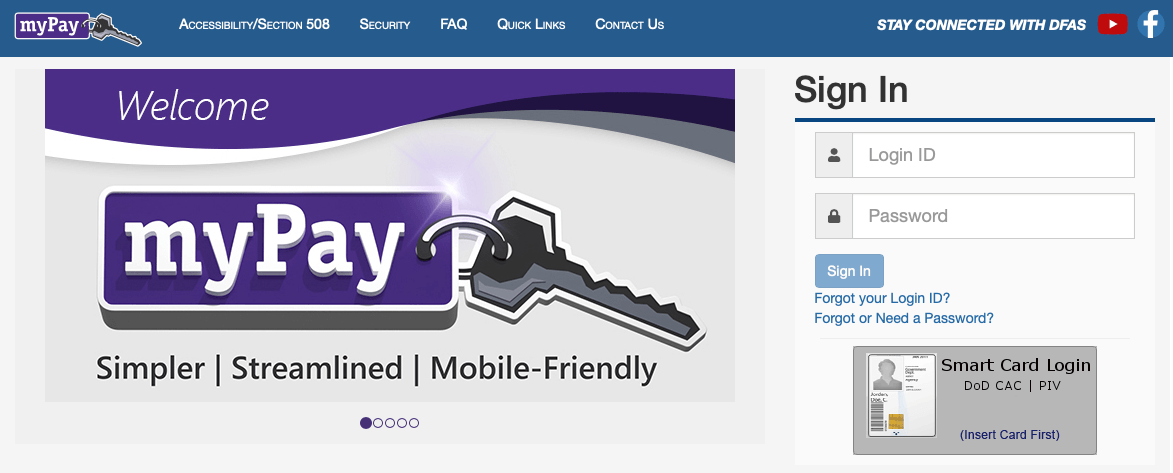

How can I access Mypay.dfas?

To access Mypay.dfas, you can visit the website at mypay.dfas.mil and log in using your login credentials, which typically include your Social Security Number (SSN) or Department of Defense Identification Number (DoD ID) and your password.

What services can I access through Mypay.dfas?

Mypay.dfas allows users to view their pay statements, manage allotments, update personal information such as address and direct deposit details, view tax statements (W-2s), and make changes to their Thrift Savings Plan (TSP) contributions.

Is Mypay.dfas secure?

Yes, Mypay.dfas employs various security measures to ensure the safety of users’ personal and financial information. These measures include encryption, secure login processes, and regular security updates to protect against unauthorized access.