In the intricate web of military bureaucracy, managing pay can often feel like navigating a labyrinth of paperwork and protocols. Enter DFAS MyPay, the digital beacon illuminating the path to efficient pay management for service members. With its intuitive interface and comprehensive features, DFAS MyPay revolutionizes how military personnel interact with their financial information, empowering them with control and transparency.

Simplify your pay management process with DFAS MyPay’s user-friendly platform, designed to streamline tasks that were once laborious and time-consuming. No more endless forms or long waits in line–now, access your pay information with just a few clicks.

Empowerment lies at the heart of DFAS MyPay, as service members gain unprecedented insight and autonomy over their financial affairs. Transparency is not just a buzzword; it’s a fundamental principle guiding every aspect of this innovative tool, ensuring that military pay becomes a clear and comprehensible aspect of service life.

Understanding the Basics of DFAS My Pay

When it comes to managing your finances efficiently, familiarity with tools like DFAS My Pay can be immensely beneficial. This section delves into the fundamental aspects of DFAS My Pay, offering insights into its functionalities and how it streamlines the process of accessing and managing your financial information.

Streamlining Financial Management

DFAS My Pay serves as a centralized platform designed to simplify the complexities of financial management for military personnel, retirees, and civilian employees. It empowers users with convenient access to crucial pay-related information, ensuring transparency and ease of navigation.

With DFAS My Pay, individuals gain the ability to efficiently handle various aspects of their pay, from accessing pay statements and tax documents to managing allotments and direct deposits. Its user-friendly interface caters to users of all levels of technological proficiency, facilitating seamless interaction and navigation.

By understanding the basics of DFAS My Pay and mastering its functionalities, users can take charge of their financial well-being with confidence and precision.

How to Access and Navigate the DFAS My Pay Portal

In this section, we’ll delve into the essential steps required to access and efficiently navigate the DFAS My Pay portal. Managing your paycheck effectively begins with gaining seamless access to this online platform, which serves as a central hub for all your pay-related information and transactions. Whether you’re a new recruit or a seasoned service member, mastering the navigation of this portal is crucial for ensuring timely and accurate management of your finances.

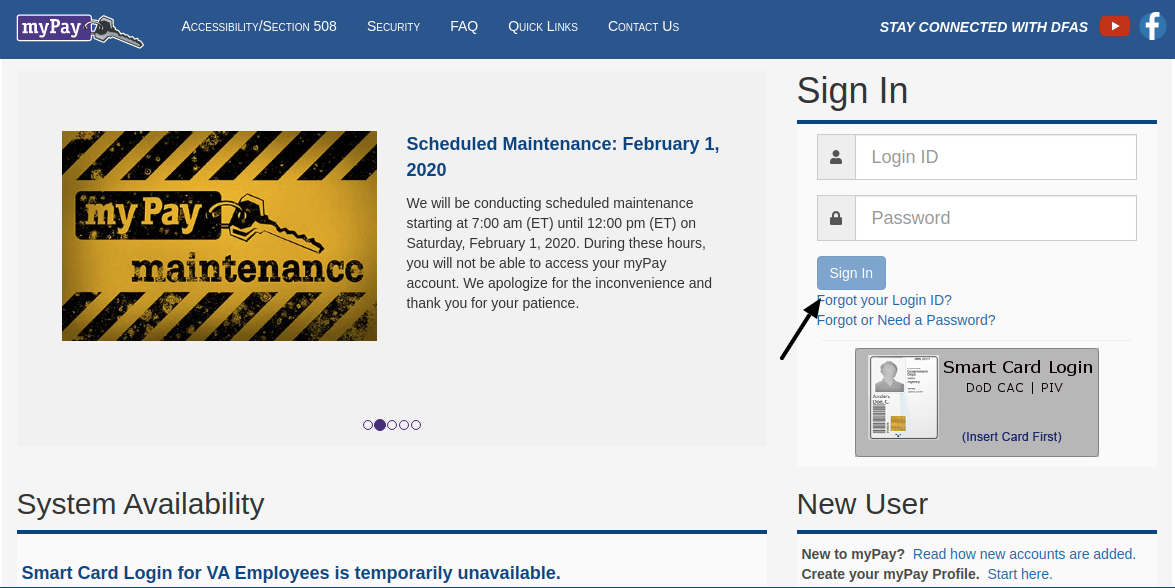

1. Logging In: The first step to accessing DFAS My Pay is logging into the portal. This typically involves entering your unique login credentials, which may include a username and password. Ensuring the security of your login information is paramount to safeguarding your personal and financial data.

2. Navigation Interface: Upon successful login, users are greeted with the portal’s user-friendly interface, designed to streamline access to various pay-related functionalities. Familiarizing yourself with the layout and menu options is key to efficiently navigating through the portal’s features.

3. Accessing Pay Information: One of the primary functions of DFAS My Pay is providing access to detailed pay information. Users can view their current and past pay statements, allowances, deductions, and tax information with ease. Navigating to the relevant sections within the portal enables quick access to the desired pay details.

4. Updating Personal Information: DFAS My Pay also allows users to update their personal information, such as contact details and banking information. Understanding how to navigate to the appropriate settings ensures that your information is always accurate and up to date.

5. Utilizing Additional Features: Beyond basic pay management, the portal offers a range of additional features and services. These may include setting up allotments, accessing travel vouchers, and enrolling in direct deposit. Learning to navigate these features empowers users to make the most of the resources available through DFAS My Pay.

6. Troubleshooting: Despite its user-friendly design, users may encounter occasional challenges while navigating the portal. Understanding common issues and troubleshooting tips can help mitigate any obstacles that may arise during usage.

By mastering the access and navigation of the DFAS My Pay portal, service members can effectively manage their paychecks, access essential information, and utilize additional services to optimize their financial management experience.

Managing Your Paycheck: Options and Features

In this section, we’ll delve into the various options and features available to manage your paycheck effectively. Understanding how to maximize your earnings and make informed decisions regarding your pay is crucial for financial stability and planning.

Direct Deposit

Direct deposit offers a convenient and secure way to receive your paycheck directly into your bank account. By setting up direct deposit, you can eliminate the need for paper checks and ensure timely access to your funds.

Payroll Deductions

Payroll deductions allow you to allocate a portion of your paycheck towards various expenses and savings goals. From retirement contributions to health insurance premiums, understanding and managing these deductions can significantly impact your overall financial picture.

- Retirement Contributions: Planning for your future by contributing to retirement accounts such as 401(k) or IRA.

- Health Insurance Premiums: Deductions for health insurance coverage provided by your employer.

- Taxes: Federal, state, and local taxes withheld from your paycheck.

- Other Benefits: Deductions for benefits like life insurance, flexible spending accounts, or commuter benefits.

By reviewing and adjusting your payroll deductions as needed, you can ensure that your paycheck aligns with your financial goals and priorities.

Exploring Additional Services and Benefits

Within the realm of managing your pay efficiently through DFAS My Pay, there exist a plethora of supplementary services and benefits that can significantly enhance your financial management experience. This section delves into various tools, resources, and perks available within the DFAS My Pay platform, aimed at optimizing your financial well-being and simplifying administrative tasks.

First and foremost, navigating through the array of additional services offered by DFAS My Pay opens doors to a myriad of opportunities designed to streamline your pay management process. From tailored financial planning resources to personalized benefits assistance, these services aim to empower you with the knowledge and tools necessary to make informed decisions regarding your finances.

Furthermore, exploring the additional benefits within the DFAS My Pay portal unveils a range of perks beyond basic pay management. These may include access to exclusive discounts, specialized insurance programs, educational resources, and retirement planning tools. By taking advantage of these offerings, you can not only optimize your current financial situation but also lay the groundwork for long-term stability and security.

Moreover, delving into the realm of supplementary services within DFAS My Pay provides an opportunity to discover hidden gems that can augment your overall financial well-being. Whether it’s accessing educational materials to enhance your financial literacy or utilizing budgeting tools to track expenses, these resources empower you to take control of your financial future.

In conclusion, exploring the additional services and benefits within the DFAS My Pay platform goes beyond mere pay management; it’s about equipping yourself with the knowledge and resources to thrive financially. By leveraging these offerings, you can navigate the complexities of personal finance with confidence and ease, ultimately paving the way for a more secure and prosperous future.

Tips and Tricks for Efficient Pay Management

Efficiently managing your pay is crucial for maintaining financial stability and achieving your long-term financial goals. In this section, we will explore various strategies and techniques to help you make the most out of your earnings without compromising your financial well-being.

1. Budget Wisely: Creating a detailed budget is the cornerstone of effective pay management. Track your expenses diligently, categorize them, and allocate a specific portion of your income to each category. Consider using budgeting apps or spreadsheets to streamline this process.

2. Automate Savings: Take advantage of automated savings options provided by your bank or financial institution. Set up automatic transfers from your paycheck to your savings account to ensure consistent savings without the temptation to spend impulsively.

3. Minimize Debt: Prioritize paying off high-interest debts to avoid accruing unnecessary interest charges. Consider consolidating debts or negotiating lower interest rates with creditors to accelerate your debt repayment journey.

4. Maximize Retirement Contributions: If your employer offers a retirement savings plan such as a 401(k) or a similar option, contribute as much as you can afford, especially if your employer matches contributions. Maxing out these contributions can significantly boost your long-term financial security.

5. Stay Informed: Keep yourself updated on changes in tax laws, company benefits, and other financial regulations that may impact your pay and overall financial situation. Being informed empowers you to make better financial decisions.

6. Plan for Emergencies: Build an emergency fund to cover unexpected expenses such as medical bills, car repairs, or job loss. Aim to save enough to cover at least three to six months’ worth of living expenses to provide a financial safety net.

7. Seek Professional Advice: If you’re unsure about the best strategies for managing your pay or optimizing your financial situation, don’t hesitate to seek guidance from a financial advisor. They can provide personalized advice based on your unique circumstances and goals.

By implementing these tips and tricks, you can enhance your financial well-being and achieve greater stability and security in managing your pay.

Common FAQs and Troubleshooting Tips

In this section, we address common questions and offer troubleshooting tips to assist you in navigating through potential issues smoothly. Whether you’re encountering difficulties accessing your DFAS My Pay account or need clarification on certain features, we’ve got you covered.

Here, we aim to provide clear explanations and step-by-step solutions to the most frequently asked questions regarding DFAS My Pay. From resolving login issues to understanding various functionalities within the portal, our FAQs cover a wide range of topics to ensure you can effectively manage your pay with confidence.

Additionally, we offer troubleshooting tips for common challenges that users may encounter while utilizing DFAS My Pay. Whether it’s troubleshooting errors during account setup or troubleshooting discrepancies in your paycheck, we provide practical guidance to help you overcome these obstacles.

By familiarizing yourself with the FAQs and troubleshooting tips provided in this section, you can streamline your experience with DFAS My Pay and effectively address any issues that may arise along the way.

What is DFAS MyPay?

DFAS MyPay is an online portal provided by the Defense Finance and Accounting Service (DFAS) that allows members of the military, retirees, and DoD civilian employees to access and manage their pay information, including leave balances, tax forms, and allotments.

How can I access DFAS MyPay?

To access DFAS MyPay, you can visit the official website and log in using your unique username and password. Alternatively, you can use the DFAS MyPay app available for download on mobile devices.

What information can I view on DFAS MyPay?

DFAS MyPay allows users to view a variety of pay-related information, including LES (Leave and Earnings Statement), tax statements (such as W-2s), retirement account information, and allotments. Users can also update personal information and manage direct deposit settings.

Is DFAS MyPay secure?

Yes, DFAS MyPay employs stringent security measures to ensure the protection of users’ personal and financial information. This includes encryption protocols, multi-factor authentication options, and regular security audits to identify and address any vulnerabilities.

Can I make changes to my pay or benefits through DFAS MyPay?

DFAS MyPay allows users to make certain changes to their pay and benefits, such as updating direct deposit information, adjusting tax withholding preferences, and managing allotments. However, some changes may require additional verification or approval.

What is DFAS MyPay?

DFAS MyPay is an online portal provided by the Defense Finance and Accounting Service (DFAS) that allows members of the U.S. military and civilian employees to access and manage their pay and benefits information conveniently and securely.